The 4-Minute Rule for Succentrix Business Advisors

The 9-Minute Rule for Succentrix Business Advisors

Table of ContentsThe Facts About Succentrix Business Advisors RevealedLittle Known Facts About Succentrix Business Advisors.Succentrix Business Advisors Things To Know Before You BuySome Known Incorrect Statements About Succentrix Business Advisors How Succentrix Business Advisors can Save You Time, Stress, and Money.

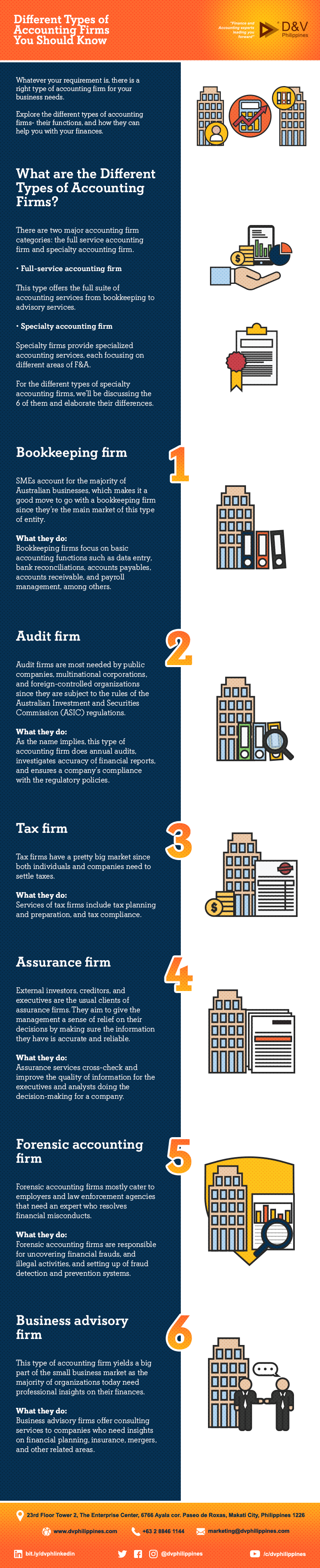

Getty Images/ sturti Outsourcing accountancy services can maximize your time, avoid errors and also minimize your tax bill. Yet the dizzying range of options may leave you frustrated. Do you require a bookkeeper or a licensed public accounting professional (CPA)? Or, maybe you wish to handle your general audit tasks, like balance dues, yet employ an expert for money flow projecting.Discover the various kinds of bookkeeping solutions available and discover just how to choose the appropriate one for your small company demands. General audit refers to normal responsibilities, such as taping transactions, whereas economic audit plans for future development.

They might additionally fix up banking declarations and document settlements. Prepare and file tax returns, make quarterly tax obligation repayments, data extensions and manage IRS audits. Find A CPA. Local business owners likewise examine their tax obligation concern and remain abreast of upcoming adjustments to avoid paying more than needed. Generate financial statements, consisting of the annual report, profit and loss (P&L), capital, and revenue statements.

The Buzz on Succentrix Business Advisors

Track job hours, compute wages, hold back tax obligations, concern checks to employees and guarantee accuracy. Accounting services may likewise include making pay-roll tax payments. Furthermore, you can employ experts to create and set up your accountancy system, supply economic preparation suggestions and describe economic declarations. You can outsource chief economic policeman (CFO) solutions, such as sequence preparation and oversight of mergers and procurements.

Often, tiny company owners outsource tax obligation services first and include pay-roll support as their business expands., 68% of participants make use of an exterior tax obligation expert or accountant to prepare their company's taxes.

Produce a checklist of procedures and obligations, and highlight those that you're willing to outsource. Next off, it's time to find the ideal accounting company (cpa near me). Since you have an idea of what type of bookkeeping services you need, the question is, who should you hire to offer them? For example, while a bookkeeper deals with data entry, a CPA can talk in your place to the internal revenue service and give financial recommendations.

The 20-Second Trick For Succentrix Business Advisors

Before making a decision, think about these questions: Do you desire a regional accountancy expert, or are you comfortable working practically? Does your organization call for sector knowledge to carry out bookkeeping tasks? Should your outsourced services integrate with existing audit tools? Do you desire to contract out human resources (HUMAN RESOURCES) and payroll to the very same vendor? Are you searching for year-round support or end-of-year tax monitoring solutions? Can a professional finish the work, or do you need a group of professionals? Do you need a mobile application or online website to supervise your accounting services? Carbon monoxide intends to bring you inspiration from leading respected experts.

Given you by Let's Make Tea Breaks Happen! Look for a Pure Fallen Leave Tea Break Grant The Pure Fallen Leave Tea Break Grants Program for small services and 501( c)( 3) nonprofits is now open! Obtain a possibility to money ideas that foster healthier workplace culture and norms! Concepts can be brand-new or currently underway, can come from human resources, C-level, or the frontline- as long as they boost staff member health via society adjustment.

Something failed. Wait a moment and try again Attempt once more.

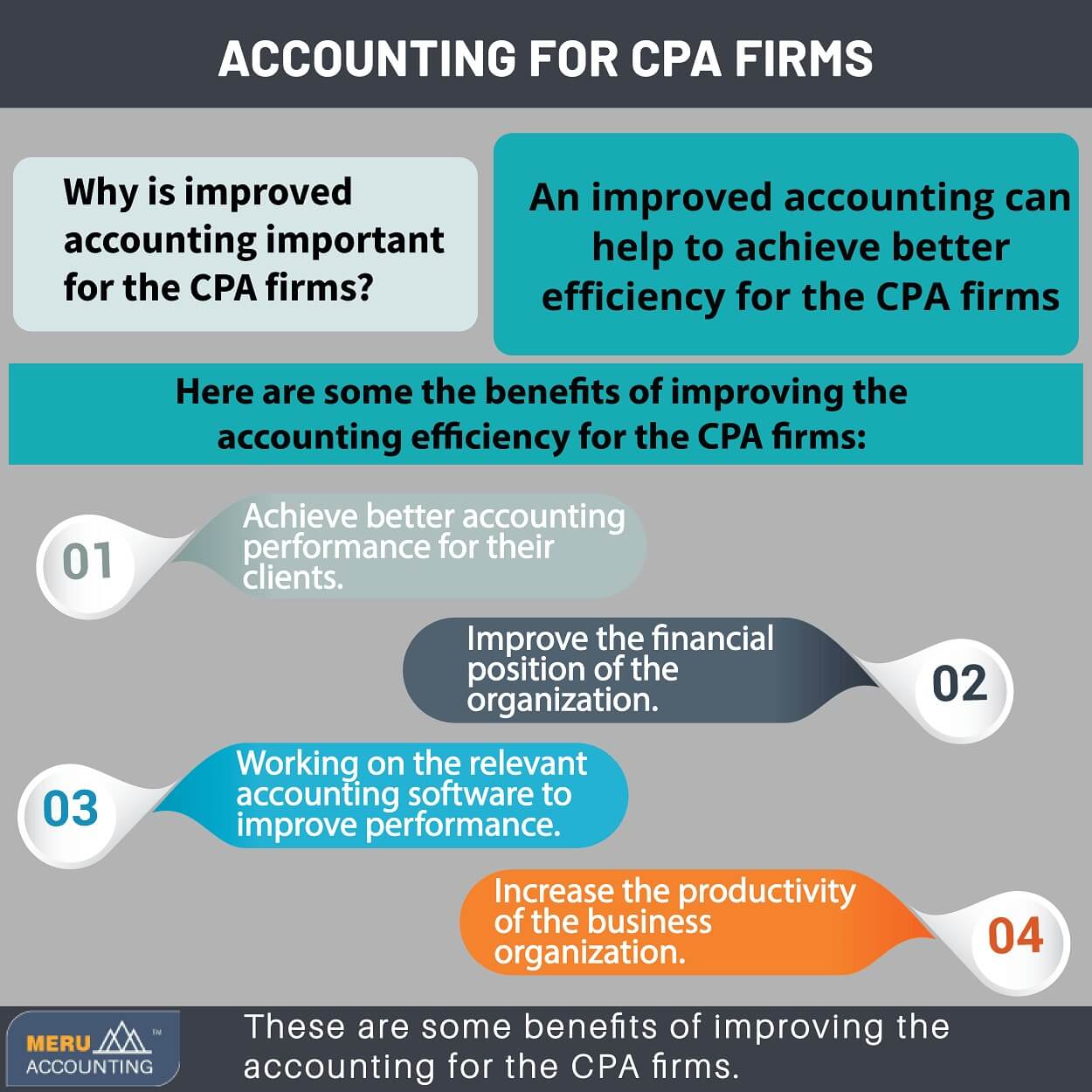

Advisors supply important insights into tax obligation approaches, making certain businesses reduce tax obligation obligations while abiding by intricate tax obligation regulations. Tax planning includes aggressive measures helpful site to optimize a company's tax position, such as deductions, credit scores, and motivations. Staying up to date with ever-evolving accounting standards and regulatory requirements is vital for businesses. Accounting Advisory specialists help in financial reporting, guaranteeing accurate and compliant monetary statements.

The Single Strategy To Use For Succentrix Business Advisors

Right here's a thorough take a look at these necessary abilities: Analytical abilities is an essential skill of Accounting Advisory Services. You ought to excel in celebration and assessing financial data, drawing meaningful insights, and making data-driven recommendations. These abilities will certainly allow you to analyze economic performance, identify patterns, and offer informed guidance to your clients.

Interacting efficiently to customers is a vital ability every accountant should have. You need to be able to communicate complex monetary info and insights to clients and stakeholders in a clear, understandable manner. This consists of the capability to translate economic lingo right into plain language, develop thorough records, and deliver impactful discussions.

Succentrix Business Advisors - Truths

Audit Advisory companies utilize modeling strategies to mimic different financial situations, analyze possible outcomes, and support decision-making. Effectiveness in financial modeling is essential for precise projecting and tactical preparation. As a bookkeeping advisory firm you must be fluent in financial guidelines, audit requirements, and tax regulations appropriate to your clients' sectors.